iowa inheritance tax rates 2020

680 on taxable income between 30781 and 46170. Iowa has no estate tax but does have an inheritance tax.

Iowa Legislature Passes Bill To Cut Income Inheritance And Property Taxes

Iowa inheritance Tax Rate C 2020 Up to 50000.

. How much is the inheritance tax in Iowa. Learn About Property Tax. 12501-25000 has an Iowa inheritance tax rate of 6.

It has an inheritance tax with a top tax rate of 18. In 2013 the Indiana legislature repealed their inheritance tax completely. Land protection may reduce the value of your land which in turn reduces the value of your estate and may reduce your federal estate tax and state inheritance tax.

Tax Rate B. Bracket Tax Is This Amount Plus This Percentage Of the Amount Over 0 to 2600 0 plus 10 0 2600 to 9450 260 plus 24. It has an inheritance tax with a top tax rate of 18.

Each marginal rate only applies to earnings within the. Inheritance tax nil-rate band and residence nil-rate band - The inheritance tax nil-rate bands are already set at current levels until April 2026 and will stay fixed at these levels. This is for siblings half-siblings and children-in-law.

Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty. That is worse than Iowas top inheritance tax rate of 15. What is the inheritance tax 2020.

Iowa Inheritance Tax Rates. Many questions about Iowa inheritance tax can be answered by reference to the Iowa Inheritance Tax Rate Schedule which can be found at the Iowa Department of Revenue website. 0-12500 has an Iowa inheritance tax rate of 5.

Read more about Inheritance Tax Rates Schedule. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code section 450101-4 are reduced by 40. 612 on taxable income between 13852 and 23085.

648 on taxable income between 23086 and 30780. Register for a Permit. A summary of the different categories is as follows.

Iowa Inheritance Tax Rates. A bigger difference between the two states is how the exemptions to the tax work. Iowa state income tax rate table for the 2022 - 2023 filing season has nine income tax brackets with IA tax rates of 033 067 225 414 563 596 625 744.

25001-75500 has an Iowa inheritance tax rate of 7. Iowa Inheritance Tax Rates. Iowa has nine marginal tax brackets ranging from 033 the lowest Iowa tax bracket to 853 the highest Iowa tax bracket.

The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. If the net estate of the decedent found on line 5 of IA. That is worse than Iowas top inheritance tax rate of 15.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. How much is the inheritance tax in Iowa. This is for uncles aunts.

ESTATEGIFT TAX RATE SCHEDULE. The rate ranges from 5 to 10 based on the size of the inheritance. Learn About Sales Use.

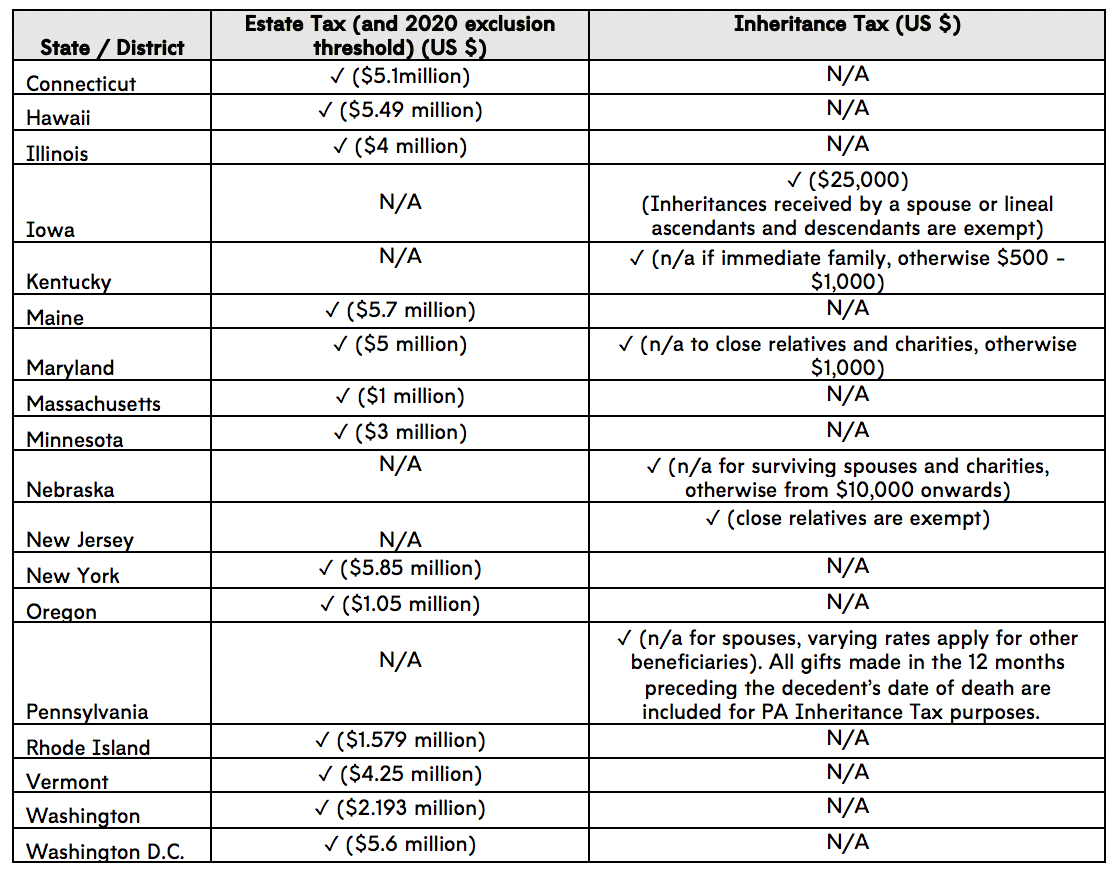

Change or Cancel a Permit. It has an inheritance tax with a top tax rate of 18. States that collect an inheritance tax.

Inheritance Tax Rates Schedule. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit. How do I avoid inheritance tax in.

Track or File Rent Reimbursement. The applicable tax rates. That is worse than Iowas top inheritance tax rate of 15.

2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Iowa Estate Tax Everything You Need To Know Smartasset

U S States Imposing Estate And Inheritance Taxes Asena Advisors

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Death And Taxes Nebraska S Inheritance Tax

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

How Do State And Local Corporate Income Taxes Work Tax Policy Center

State By State Estate And Inheritance Tax Rates Everplans

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub