student loan debt relief tax credit virginia

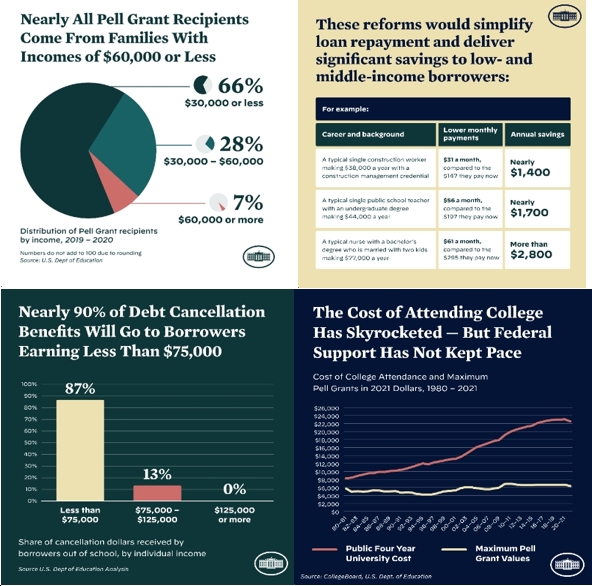

The debt forgiveness plan announced in August would cancel 10000 in student loan debt for those making less than 125000 or households with less than 250000 in income. In March 2021 President Joe Biden signed the American Rescue Plan into law which included a clause regarding student loan forgiveness saying that any federal student loans that were.

VIRGINIA Student loan borrowers in Virginia can now apply for 10000 to 20000 in student loan forgiveness even as the presidents debt relief program faces court challenges.

. Participants in the program who earn less than 55000 annually receive benefits covering 100 percent of their qualifying law. 21 2022 in Dover Del. CuraDebt is a company that provides debt relief from Hollywood Florida.

Student Loan Debt Relief Tax Credit Virginia. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who. About the Company Virginia Student Loan Debt Relief Tax Credit.

Complete the Student Loan Debt Relief Tax Credit application. Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their student loan. Court of Appeals for the Eighth Circuit which sided with.

It was founded in 2000 and has been a. It was established in 2000 and has been a participant in the american fair credit council the us chamber of commerce and is accredited. Pell Grant recipients would be.

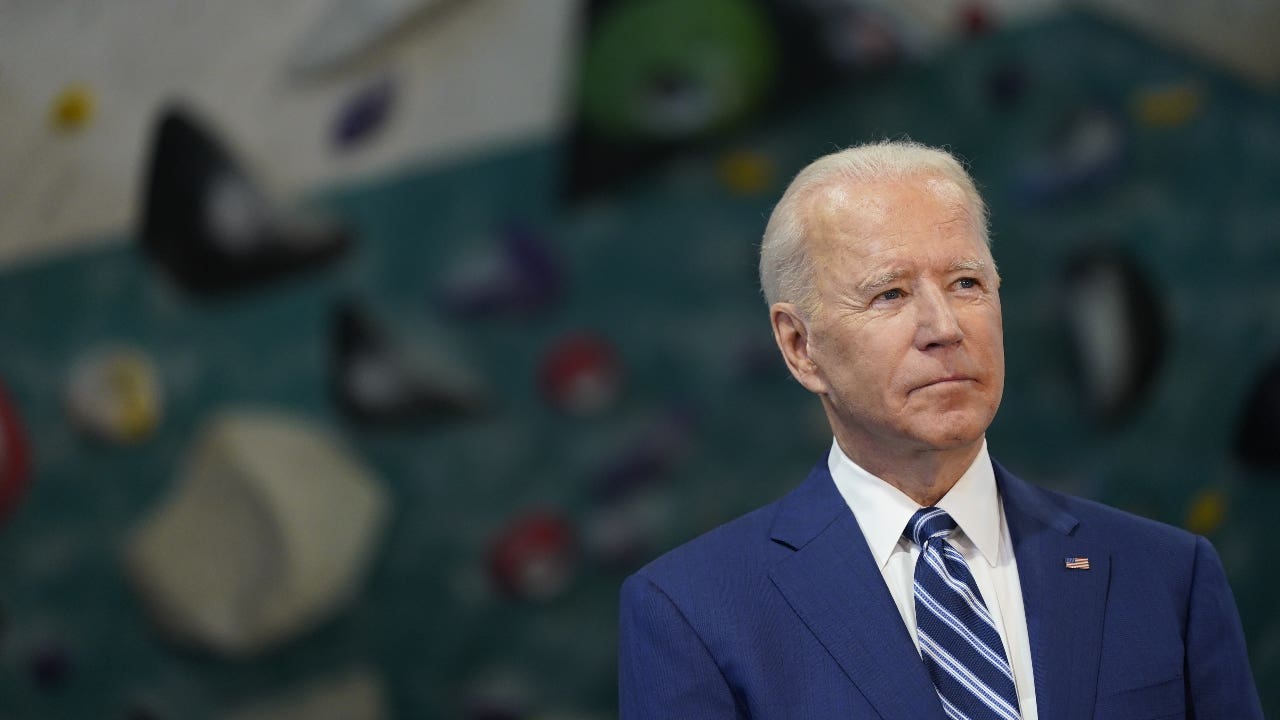

FILE - President Joe Biden speaks about student loan debt relief at Delaware State University Friday Oct. If you receive student loan forgiveness in Indiana for example you can expect to pay 323 in state taxes for 10000 in debt relief and 646 in state taxes for 20000 in forgiveness. If you receive student loan forgiveness in Indiana for example you can expect to pay 323 in state taxes for 10000 in debt relief and 646 in state taxes for 20000 in forgiveness.

Complete the Student Loan Debt Relief Tax Credit application. The Biden administration plans to ask the Supreme Court to reinstate the presidents student debt cancellation plan according to a Thursday legal filing warning that millions of Americans. One-time forgiveness of up to 20000 per borrower was a key part of the presidents plans to make.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. These legal developments leave Bidens marquee student debt relief initiative in limbo. Virginia Loan Forgiveness Program.

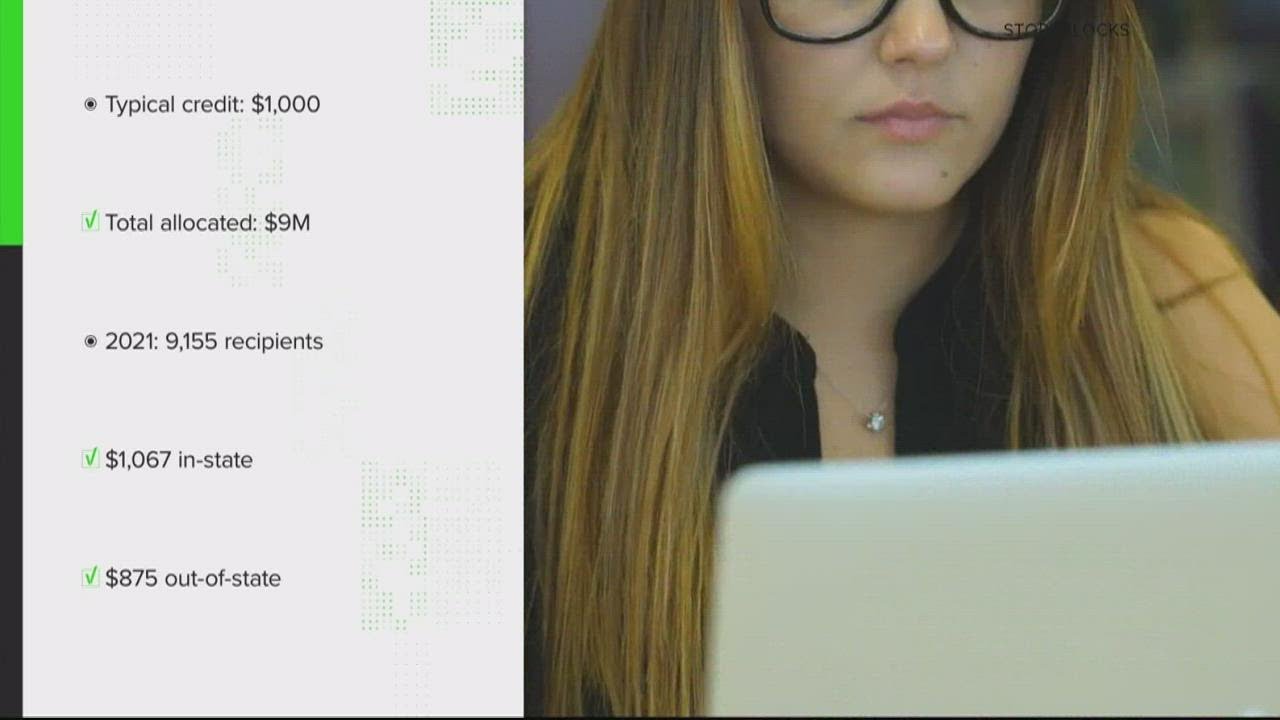

The debt forgiveness plan announced in August would cancel 10000 in student loan debt for those making less than 125000 or households with less than 250000 in income. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Review the credits below to see what you may be able to deduct from the tax you owe.

The Biden administration is no longer accepting. Finally the Justice Department will ask the Supreme Court to lift an injunction currently blocking its debt-relief plan issued by the US. WASHINGTON - People in line to benefit from President Bidens plan to cancel up to 20000 in student loans could be taxed on the one-time relief depending on where they live.

Factoring in 10000 of debt relief below is the maximum tax liability student-loan borrowers could face in the 13 states identified by the Tax Foundation. To help relieve borrowers Biden announced last month that he would cancel 10000 in student loan debt for borrowers who make less than 125000 a year. This refundable tax credit is for families with qualifying children.

In addition to credits Virginia offers a number of deductions and subtractions. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Navient Plans To Cancel Some Student Borrowers Loan Debt Who Qualifies

What Biden S 2023 Budget Means For Student Loan Forgiveness Bankrate

Virginia Student Loans Debt Statistics Student Loan Hero

Fact Sheet President Biden Announces Student Loan Relief For Borrowers Who Need It Most Blue Virginia

Student Borrowers In These 13 States May Owe Taxes On Biden S Debt Relief Cbs News

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Some States Could Tax Biden S Student Loan Debt Relief Is Illinois One Of Them Nbc Chicago

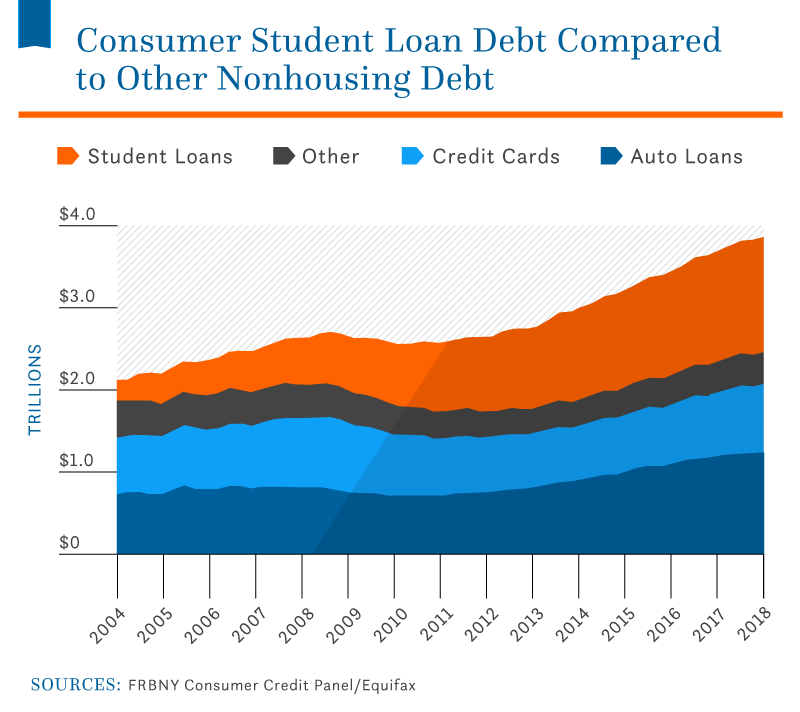

Chart Americans Owe 1 75 Trillion In Student Debt Statista

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Student Loan Debt Cancellation And Taxes Kiplinger

/cdn.vox-cdn.com/uploads/chorus_asset/file/24140355/1435393569.jpeg)

Biden S Student Debt Forgiveness Program Is Likely To Be Killed By Gop Judges Vox

Biden S Student Loan Forgiveness You Can Opt Out If You Want To Kiplinger

Student Loan Debt 2022 Facts Statistics Nitro

These 6 States May Tax Your Student Loan Forgiveness As Income Inc Com

.png?width=701&name=Student%20Debt%20Statistics_Asset_6%20(2).png)

Student Loan Debt 2022 Facts Statistics Nitro